1. When the

government issues ration coupons, it is an indication that the government has

prohibited the use of which rationing mechanism?

a. merit

b. need

c. price

d. age

2. If the equilibrium

price of bread is $2 and the government imposes a $1.50 price ceiling on the

price of bread,

a. more bread will be produced to meet the increased demand.

b. there will be a shortage of bread.

c. the demand for bread will decrease because suppliers will

reduce their supply.

d. a surplus of bread will emerge.

3. Rent controls

typically end up

a. increasing rents received by landlords.

b. raising property values.

c. encouraging landlords to overspend for maintenance.

d. discouraging new housing construction.

4. A price ceiling

might be an appropriate government response to a

a. period of falling farm prices due to unusually good

harvests.

b. substantial increase in farm productivity due to

applications of new technology in agriculture.

c. national security crisis leading to major shortages of

essential goods.

d. period of extraordinary large surpluses of farm goods.

5. Suppose that the

government places a price ceiling in the fish market, and that the ration

coupons it issues are bought and sold on a ration coupon market before they are

used to purchase fish. The

a. excess supply of fish will be eliminated.

b. purpose of that price ceiling would be defeated.

c. price ceiling must have been too low.

d. price of fish set by the price ceiling would rise.

6. Assume that the

government sets a ceiling on the interest rate that banks charge on loans. If

the ceiling is set below the market equilibrium interest rate, the result will

be

a. a surplus of credit.

b. a shortage of credit.

c. greater profits for banks issuing credit.

d. a perfectly inelastic supply of credit in the market

place.

7. In a market where

the government imposes a price control, the excess demand or excess supply

created will be determined by the

a. imposed price and the slope of the demand curve.

b. imposed price and the slope of the supply curve.

c. difference between quantity demanded and quantity

supplied at the imposed price.

d. difference between the imposed price and the equilibrium

price.

8. Government-created

price floors are typically imposed to

a. help consumers.

b. help producers.

c. raise tax revenue.

d. shift the supply curve to the right.

9. Suppose the

government imposed a minimum price in a market and a reporter for a local

newspaper wrote a story on it. The headline on the story would read:

a. “Government Action Calls for Ration Coupons”

b. “Rationing Price Replaces Market Price”

c. “Price Ceiling Replaces Equilibrium Price”

d. “Price Floor Protects Sellers from Low Incomes”

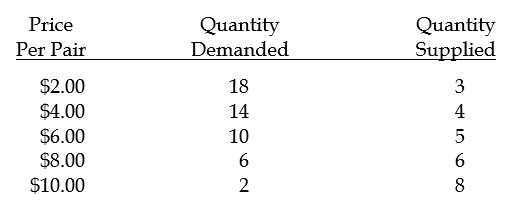

10. In the supply and

demand schedules for socks shown here, if a price floor of $10 is imposed by

the government, the quantity of socks actually purchased will be

a. 6 units.

b. 10 units.

c. 2 units.

d. 8 units.

11. In the supply and

demand schedules for socks shown here, if a price floor of $10 is imposed by

the government, there will be a

a. surplus of socks equal to 8 pairs.

b. shortage of socks equal to 16 pairs.

c. surplus of socks equal to 6 pairs.

d. market clearing quantity of 6 pairs of socks exchanged.

12. When the minimum

wage is set above the equilibrium market wage,

a. there will be an excess demand for labor at the minimum

wage.

b. it will have no effect on the quantity of labor employed.

c. the unemployment rate will rise.

d. the quality of the labor force will rise.

13. If the government

imposes a binding price floor on sugar, it may also have to

a. establish programs to expand supply in the private sector.

b. establish programs to reduce demand in the private

sector.

c. produce some sugar itself.

d. purchase the surplus sugar.

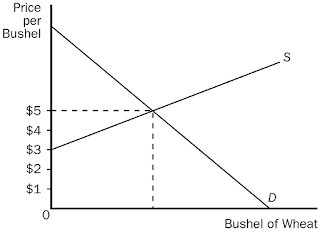

14. Consider this

diagram, which shows the market for wheat. A price floor of $2.00 per bushel is

a. binding and will generate a surplus of 100 bushels.

b. not binding and will generate a shortage of 100 bushels.

c. binding and will generate an equilibrium in this market.

d. not binding.

15. A tax on sales of

a good, when compared to the market equilibrium without the tax, will result in

a __________ price paid by buyers and a __________ quantity traded.

a. higher; lower

b. lower; lower

c. higher; higher

d. lower; higher

16. Taxes levied

directly on consumers

a. always hurt consumers rather than producers.

b. always hurt producers rather than consumers.

c. generate more revenue than taxes levied on producers.

d. have the same effect as taxes directly levied on

producers.

17. The per-unit tax

on a good is the

a. difference between the list price and the actual price paid

by the buyer.

b. licensing fees and other business taxes paid by sellers,

averaged over the total quantity of goods sold.

c. difference between the total price paid by the buyer and

the price received by the seller.

d. difference between wholesale and retail prices.

18. Given the market

described in this diagram, the burden of the tax will fall on

a. buyers and sellers

equally.

b. only the buyers.

c. only the sellers.

d. both buyers and sellers, with sellers paying the larger

share.

19. A 5 percent tax

is levied on products A and B, both of which have the same demand elasticity.

Unit sales of A are nearly the same after the tax, while unit sales of B fall

dramatically. Which of the following can we conclude?

a. Producers of A bear a greater share (relative to

consumers) of their market’s tax burden than the producers of B.

b. Product B has a smaller elasticity of supply than product

A.

c. Tax revenue is greater from product A.

d. Tax revenue is greater from product B.

20. Consider the

impact of a tax on sellers, shown in this diagram of the market for whiskey. In

this case, the total tax revenue collected by the government is

a. $3.00.

b. $1500.00.

c. $13,500.00.

d. $40,500.00.

21. Consider the

impact of a tax on sellers, shown in this diagram of the market for whiskey. In

this case, the buyers’ share is __________ and the sellers’ share is

__________.

a. $500; $500

b. $6750; $6750

c. $9000; $4500

d. None of the above are correct.

22. Suppose the

government wants to raise additional tax revenues with the least disruption to

prevailing demand patterns. For which product should an excise tax be levied?

a. Coca Cola

b. liquor

c. Cheerios

d. hot tubs

23. The government is

thinking about increasing the gasoline tax to raise additional revenue rather

than to promote conservation. The tax will result in the greatest amount of tax

revenue if the price elasticity of demand for gasoline equals

b. 1.4.

c. 1.0.

d. .5.

24. The government is

thinking about increasing the gasoline tax to promote conservation. The tax

will discourage the consumption of gasoline by the greatest extent when the

price elasticity of demand equals

a. 0.1.

b. 0.7.

c. 1.3.

d. 2.0.

25. If a new excise

tax is imposed on steak,

a. government’s tax revenue will decrease.

b. government’s tax revenue will increase.

c. amount of steak produced and sold will increase.

d. market price of steak will decrease.

26. A tax on fur

coats will most likely

a. raise large amounts of tax revenue for the government.

b. cause a large decline in the sales of fur coats because

demand is elastic.

c. be an effective way to tax the rich.

d. fall mostly on the fur coat buyers rather than the

producers.

No comments