|

| Chapter 15: Monopoly |

1. Monopolies use

their market leverage to

a. charge prices that equal minimum average total cost.

b. attain normal profits in the long run.

c. restrict output and increase price.

d. dump excess supplies of their product on the market.

2. If government

officials break a natural monopoly up into several smaller firms, then

a. competition will force firms to attain economic profits

rather than accounting profits.

b. competition will force firms to produce surplus output,

which drives up price.

c. the average costs of production will increase.

d. the average costs of production will decrease.

3. Sizable economic

profits can persist over time under monopoly if the monopolist

a. produces that output where average total cost is at a

maximum.

b. is protected by barriers to entry.

c. operates as a price taker rather than a price maker.

d. realizes revenues that exceed variable costs.

4. Most markets are

not monopolies in the real world because

a. firms usually face downward-sloping demand curves.

b. supply curves slope upward.

c. price is usually set equal to marginal cost by firms.

d. there are reasonable substitutes for most goods.

5. Patents grant

a. permanent monopoly status to creators of scientific

inventions.

b. permanent monopoly status to creators of any intellectual

property.

c. temporary monopoly status to creators of scientific

inventions.

d. temporary monopoly status to creators of any intellectual

property.

6. If a monopolist

can sell 7 units when the price is $3 and 8 units when the price is $2, then

marginal revenue of selling the eighth unit is equal to

a. $2.

b. $3.

c. $16.

d. –$5.

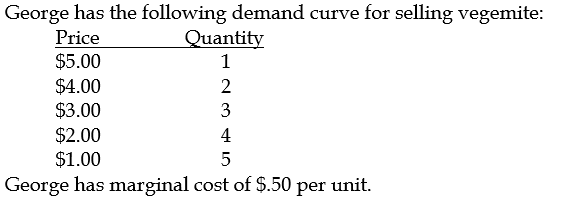

7. What is George’s

profit-maximizing level of output?

a. 1

b. 2

c. 3

d. 4

8. What is George’s

profit-maximizing price?

a. $4

b. $3

c. $2

d. $1

9. If a monopolist’s

marginal costs shift up by $1.00, then

a. the monopoly price will rise by $1.

b. the monopoly price will rise by more than $1.

c. the monopoly price will rise by less than $1.

d. there is no change in the monopoly price and profits

fall.

10. If a monopolist

has zero marginal costs it will produce

a. the output at which total revenue is maximized.

b. in the range in which marginal revenue is still

increasing.

c. at the point at which marginal revenue is at a maximum.

d. in the range in which marginal revenue is negative.

11. The supply curve

for the monopolist

a. is horizontal.

b. is vertical.

c. is a 45-degree line.

d. does not exist.

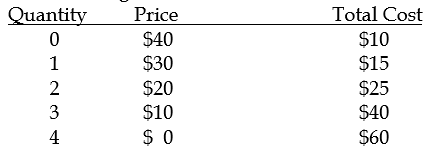

Consider the following demand and cost information for a

monopoly.

12. The marginal revenue

of the second unit is

a. $10

b. $20

c. $30

d. $40

13. The marginal cost

of the fourth unit is

a. $60

b. $40

c. $20

d. $10

14. The maximum

profit this monopolist can earn is

a. $40

b. $30

c. $20

d. $15

15. To maximize

profit, the monopolist sets price at

a. $40

b. $20

c. $0

d. $10

16. Suppose potatoes

were produced in Canada by many, many firms in perfect competition. In Belgium,

only one firm produces potatoes for the Belgium market. Suppose further that

for the competitive firms and the monopoly minimum ATC is the same. We would

expect that in Belgium the price of potatoes is __________ and __________

potatoes are produced and sold than in Canada.

a. higher; more

b. lower; more

c. higher; fewer

d. lower; fewer

17. “Monopolists do

not worry about efficient production and cost saving since they can just pass

along any increase in costs to their consumers.” This statement is

a. false; price increases will mean fewer sales, and lower

costs will mean higher profits (or smaller losses).

b. true; this is the primary reason why economists believe

that monopolies result in economic inefficiency.

c. false; the monopolist is a price taker.

d. true; consumers in a monopoly market have no substitutes

to turn to when the monopolist raises prices.

18. Many economists

criticize monopolists because they produce at output levels that are not

efficient. That is to say, monopolists

a. charge too high a price.

b. don’t innovate.

c. produce a large quantity of waste.

d. have no incentive to produce at their minimum ATC.

19. Concerning public

utilities, the stated reason for resorting to regulation of a monopoly, rather

than promoting competition through antitrust, is that the industry in question

is believed to be a

a. profit-maximizing monopoly.

b. producer of externalities.

c. revenue-maximizing monopoly.

d. natural monopoly.

20. Splitting up a

monopoly is often justified on the grounds that

a. consumers prefer dealing with small firms.

b. small firms have lower costs.

c. competition is inherently efficient.

d. nationalization is a less-preferred option.

21. The first major

piece of antitrust legislation was the

a. Clayton Act.

b. Celler-Kefauver Act.

c. Sherman Act.

d. Robinson-Patman Act.

22. The task of

economic regulation is to

a. protect monopoly profits.

b. approximate the results of the competitive market.

c. replace competition with government ownership.

d. increase competition within the market.

23. Which of the

following is an example of price discrimination?

a. Nabisco provides cents-off coupons for its products.

b. Amtrak offers a lower price for weekend travel compared

to weekday rates on the same routes.

c. Hotel rates for AAA members are lower than for

nonmembers.

d. All of the above are correct.

24. A monopolist that

practices perfect price discrimination

a. creates no deadweight loss.

b. charges one group of buyers a higher price than another

group, such as offering a student discount.

c. produces the same monopoly level of output as when a

single price is charged.

d. charges some customers a price below marginal cost

because costs are covered by the high-priced buyers.

25. A monopolist’s

profits with price discrimination will be

a. lower than if the firm charged a single,

profit-maximizing price

b. the same as if the firm charged a single,

profit-maximizing price.

c. higher than if the firm charged just one price because

the firm will capture more consumer surplus.

d. higher than if the firm charged a single price because

the costs of selling the good will be lower.

No comments