1. Market failure in

the form of externalities arises when

a. production costs are included in the prices of goods.

b. not all costs and benefits are included in the prices of

goods.

c. the benefits exceed the costs of consuming goods.

d. the market fails to achieve equilibrium.

2. Which of the

following is an example of a positive externality?

a. air pollution

b. a person littering in a public park

c. a nice garden in front of your neighbor’s house

d. the pollution of a stream

3. The social cost of

a good is

a. its benefit to the people who buy and consume it.

b. its total benefit to everyone in society.

c. its cost to everyone in the society that occurs in

addition to the private costs.

d. the cost paid by the firm that produces and sells it

.

4. The private

benefit of consuming a good is

a. its benefit to the people who buy and consume it.

b. its total benefit to everyone in the society.

c. its cost to everyone in the society.

d. the cost paid by the firm that produces and sells it.

5. When a person

drives a car that pollutes the air the

a. private cost of consuming the car’s services exceeds the

social cost.

b. private benefit of consuming the car’s services exceeds

the social benefit.

c. social cost of consuming the car’s services exceeds the

private cost.

d. social benefit of consuming the car’s services exceeds

the private benefits.

6. If a perfectly

competitive industry is not forced to take account of a negative externality it

creates, it will produce where

a. the marginal cost of production equals the marginal

private benefit.

b. the marginal cost of production equals the marginal

social benefit.

c. the marginal social cost of production equals the

marginal social benefit.

d. price equals marginal social benefit.

7. Flu shots are

associated with a positive externality. (Those who come in contact with people

who are inoculated are helped as well.) Given perfect competition with no

government intervention in the vaccination market, which of the following

holds?

a. At the current output level, the marginal social benefit

exceeds the marginal private benefit.

b. The current output level is inefficiently low.

c. A per-shot subsidy could turn an inefficient situation

into an efficient one.

d. All of the above are correct.

8. Because there are

positive externalities from higher education,

a. private markets would provide too little of it.

b. private markets would provide too much of it.

c. the government should impose a tax on college students.

d. the government should impose a tax on students’ families.

9. This diagram

represents the tobacco industry. Which of the following would be included in

the supply (private cost) curve?

a. the cost of labor

b. the cost to the government of the hospital expenses of

smokers with cancer

c. the increased risk of cancer to the nonsmoking passengers

in the smoker’s car pool

d. the price of a pack of cigarettes

10. This diagram

represents the tobacco industry. It is clear that the industry creates

a. positive externalities.

b. negative externalities.

c. no externalities.

d. no equilibrium in the market.

11. This diagram

represents the tobacco industry. The market creates an equilibrium price and

quantity exchanged of

a. $1.90 and 42 units.

b. $1.80 and 35 units.

c. $1.60 and 42 units.

d. $1.35 and 59 units.

12. This diagram

represents the tobacco industry. The socially optimal price and quantity

exchanged are

a. $1.90 and 42 units.

b. $1.80 and 35 units.

c. $1.60 and 42 units.

d. $1.35 and 59 units.

13. This diagram

represents the tobacco industry. If the government uses a pollution tax, how

much of a tax must be imposed on each unit of production?

a. $1.30

b. $0.50

c. $1.80

d. $0.30

14. This diagram

represents the tobacco industry. If the government uses a pollution tax, how

much tax revenue will the government receive?

a. $12.60

b. $10.50

c. $66.50

d. $63.00

15. Internalizing an

externality means

a. the good becomes a public good.

b. government regulations or taxes are sufficient to

eliminate the externality completely.

c. government imposes regulations that eliminate the

externality completely.

d. incentives are altered so that people take account of the

external effects of their actions.

16. A dentist shared

an office building with a radio station. The electrical current from the

dentist’s drill causes static in the radio broadcast, causing the radio station

to lose $10,000 in discounted future profits. The radio station could put up a

shield at a cost of $30,000; the dentist could buy a new drill that causes less

interference for $6,000. Either would restore the radio station's lost profits.

What is the economically efficient outcome?

a. The radio station puts up a shield, which it pays for.

b. The radio station puts up a shield, which the dentist

pays for.

c. The radio station does not put up a shield and the

dentist does not buy a new drill.

d. The dentist gets a new drill and it does not matter who

pays for it.

17. Why can’t private

individuals always internalize an externality without the help of government?

a. Legal restrictions prevent side payments between

individuals.

b. Transactions costs may be too high.

c. Side payments between individuals are inefficient.

d. Side payments between individuals violate equity

standards.

18. What economic

argument suggests that if transactions costs are sufficiently low, the

equilibrium is economically efficient regardless of how property rights are

distributed?

a. The Coase Theorem

b. Say’s Law

c. The Law of Comparative Advantage

d. The Law of Supply

19. Assume the

production of the product in the figure imposes a cost on society of $7.00 per

unit. If the free market equilibrium output is 50 units, the government should

a. impose a tax of $2.50 per unit.

b. reduce the output of the firm by approximately 39 units.

c. impose a lump-sum tax of $350 per period.

d. impose a tax of $7.00 per unit.

20. A benefit of

taxes over regulation to internalize externalities is

a. it is easier to choose the optimal amount of taxes than

the optimal amount of regulation.

b. regulations are more difficult to impose than taxes.

c. taxes equate the social costs with the social benefits.

d. taxes provide incentives to adopt new methods to reduce

the externality.

21. If the government

wants to tax a polluter, the economically efficient outcome occurs when the

a. marginal tax equals the marginal cost to other people

from the pollution.

b. average tax equals the average cost to other people from

the pollution.

c. total tax equals the total cost to other people from the

pollution.

d. tax is high enough to stop pollution completely.

22. Which of the

following is NOT a method that could effectively deal with negative

externalities?

a. relying on voluntary compliance

b. taxing the output of industries that pollute

c. creating legal environmental standards

d. increasing public spending on cleanup and reduction of

pollution

23. A common

complaint about environmental regulation and enforcement is that it

a. applies only to firms that produce goods, not services.

b. is politically motivated and so is always misdirected.

c. can be too burdensome to producers who can pay the fines

more easily than they can reduce pollution.

d. results in more pollution than without the regulations.

24. The benefit to a

pollution tax over other forms of internalizing a pollution externality is that

it

a. eliminates pollution completely.

b. forces cleanup to occur.

c. is imposed only on the market with the externality.

d. creates positive externalities to compensate for negative

externalities.

25. Pollution permits

a. impose regulations on firms that they must achieve.

b. set a quantity of pollution that will exist.

c. cannot be traded between firms in order to make sure that

the worst offenders must clean up their production processes.

d. are efficient because they eliminate all pollution.

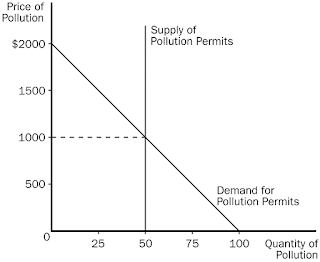

26. This diagram

shows the market for pollution when permits are issued to firms and traded in

the marketplace. The equilibrium price of pollution here is

a. $500.

b. $1000.

c. $1500.

d. $2000.

No comments