1. The market will be

in equilibrium with a tax on sales of a good when

a. the quantity

demanded equals the quantity supplied and the price buyers pay exceeds the

price sellers receive by the per-unit tax.

b. the price received

by the seller equals the price paid by the buyer and the quantity demanded is

less than the quantity supplied by the amount of the tax.

c. the tax is equal

to the price paid by the buyer and quantity demanded is equal to the quantity supplied.

d. there cannot be a

market equilibrium with a tax on sales.

2. The tax rate on a

good is the

a. total amount of

taxes paid by consumers on that good.

b. total amount of

taxes paid by producers on that good.

c. total amount of

taxes paid by both producers and consumers on that good.

d. per-unit tax on a

good, expressed as a percentage of its price.

3. Deadweight loss

a. means that there

is a loss to some individuals without a corresponding gain to others.

b. is not really a

loss to society because what one individual loses another individual gains.

c. can be eliminated

by sales taxes.

d. can occur even if

output is at the efficient level.

4. Deadweight loss

measures the

a. the amount people

would pay to gain an additional unit of a good.

b. the loss from

economic inefficiency.

c. the difference

between two efficient situations.

d. the amount

required to compensate producers for lost surplus due to the imposition of a

sales tax.

5. The deadweight

loss from an economically inefficient situation is equal to

a. consumer surplus

minus producer surplus.

b. consumer surplus

plus producer surplus.

c. the consumer and

producer surplus that people could gain by eliminating that inefficiency.

d. the increase in

consumer surplus minus the increase in producer surplus that people could gain

by eliminating that inefficiency.

6. A per-unit tax on

a good creates deadweight loss because

a. it makes demand

more inelastic.

b. it makes supply

more elastic.

c. by increasing the

price consumers pay, and reducing the price sellers receive, it prevents some

mutually beneficial trades.

d. the government

wastes the tax revenues it receives.

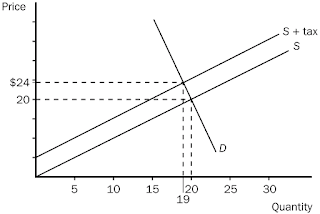

7. Consider the

impact of a tax in the market described in this diagram. The equilibrium price

and quantity exchanged in the market before the tax is

a. $100 and 25 units.

b. $20 and 20 units.

c. $19 and 20 units.

d. $0 and 25 units.

8. Consider the

impact of a tax in the market described in this diagram. The equilibrium price

and quantity exchanged in the market after the tax is

a. $100 and 25 units.

b. $20 and 20 units.

c. $24 and 19 units.

d. $19 and 19 units.

9. Consider the

impact of a tax in the market described in this diagram. The deadweight loss

attributable to the tax is

a. 2.5.

b. 5.0.

c. 95.

d. 97.5.

10. Consider the

impact of a tax in the market described in this diagram. The government will

collect

a. $100.

b. $95.

c. $50.

d. no money,

consumers will refuse to buy this good with the $5 tax.

11. If the supply

curve is perfectly elastic, a per-unit tax

a. does not create a

deadweight loss.

b. does not reduce

consumer surplus.

c. does not reduce

producer surplus.

d. reduces consumer

surplus but increases producer surplus.

12. Suppose demand

for electricity is perfectly inelastic. A tax on electricity will be

a. split between producers

and consumers in equal shares.

b. paid only by

producers.

c. paid only by

consumers.

d. split between

producers and consumers in unequal shares.

13. The coastal town

of Milford, Connecticut recently increased taxes on beachfront property. They

did this because

a. taxes on land

generate no deadweight loss and lots of revenues for government.

b. politicians

recognize that the supply of beachfront property is perfectly inelastic and so

the tax would generate no deadweight loss.

c. taxes on land are

paid entirely by the suppliers since the supply of beachfront property is

perfectly inelastic.

d. All of the above

are correct.

14. When the

government increases taxes on labor income,

a. people tend to

work harder to make up for lost income.

b. people tend to

work less because their take-home wage is lower.

c. most employers

reduce employment.

d. Any of the above

are correct, depending on the elasticities of demand and supply.

15. Which of the

following groups has a relatively elastic supply of labor?

a. heads-of-households

who must support other people with their incomes

b. elderly people on

Social Security, who can choose whether or not to work

c. second earners in

a household, who make lower wages than the primary wage earner.

d. B and C both have

relatively elastic labor supplies.

16. Which of the

following groups has a relatively inelastic supply of labor?

a. heads-of-households

who must support other people with their incomes.

b. Elderly people on

Social Security, who can choose whether or not to work.

c. second earners in

a household, who make lower wages than the primary wage earner

d. B and C, who have

relatively elastic labor supplies

17. Henry George’s

arguments were based on the idea that

a. income taxes are

optimal because they distort incentives.

b. income taxes are

optimal because they create no deadweight loss.

c. taxes on land are

optimal because they create no deadweight loss.

d. income taxes are

optimal because they are paid by employers.

18. According to

supply-side economists, the U.S. tax system tends to

a. decrease interest

rates and loans to businesses.

b. dampen incentives

to work, save, and invest.

c. reduce

unemployment and push up the price level.

d. provide lower tax

rates to people who work on salary.

19. According to the

Laffer Curve, when taxes are increased from 0 percent to a rate consistent with

the maximum point on the curve, tax revenue will

a. decrease.

b. increase.

c. be the same as the

tax rate.

d. remain constant.

20. According to

supply-side economists, a policy that __________ will cause productivity to

increase, which increases the supply of goods and services in the marketplace.

a. increases interest

rates

b. decreases

inflation

c. reduces marginal

tax rates

d. funds capital

investment in the economy

21. In the early

1980s, supply-side economists suggested that the U.S. was at

a. the minimum point

along its Laffer curve.

b. the maximum point

along its Laffer curve.

c. some point along

the rising portion of its Laffer curve.

d. some point along

the falling portion of its Laffer curve.

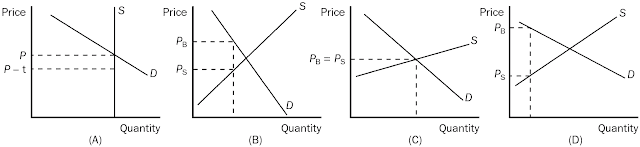

22. Consider these

diagrams. Which shows the greatest deadweight loss to its tax?

a. A

b. B

c. C

d. D

23. Consider these diagrams.

Which shows no deadweight loss to its tax?

a. A

b. B

c. C

d. D

24. The hypothesis of

the supply-siders was disputed by data from the 1980s that showed

a. decreases in tax

revenues when taxes were increased.

b. increases in tax

revenues when taxes were increased.

c. decreases in tax

revenue when taxes were decreased.

d. increases in tax

revenues when property taxes were increased.

25. U.S. policymakers

disagree most often about the effects of taxation because

a. some are

capitalists and some are communists.

b. some are

supply-siders and some are not.

c. they have

different ideas about the relative elasticities of demand and supply.

d. some are rich and

some are poor.

No comments